Employers Nic Rates 202424

BlogEmployers Nic Rates 2025/24. There are three classes of nic relevant to employment income: National insurance contributions thresholds 2025/25.

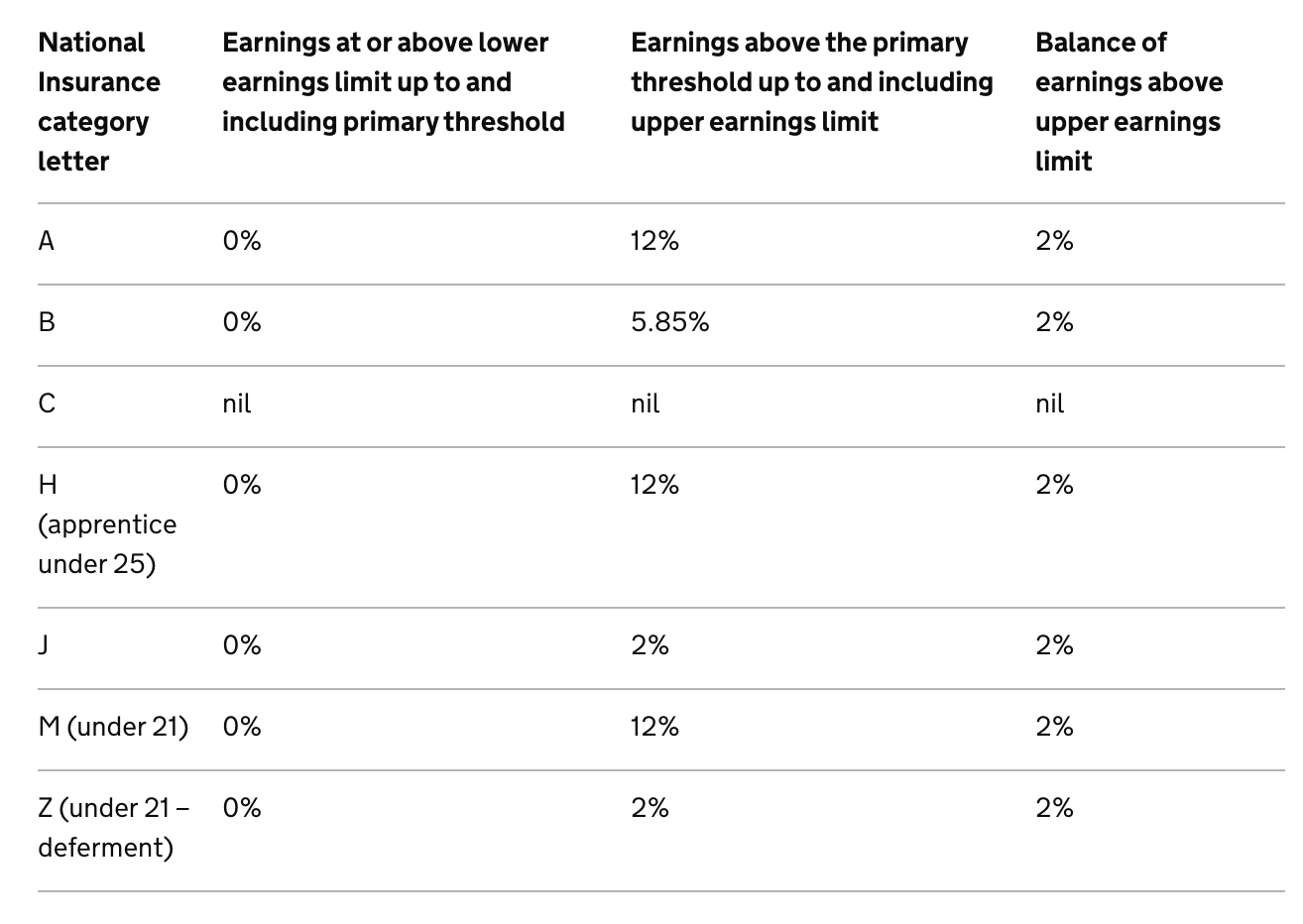

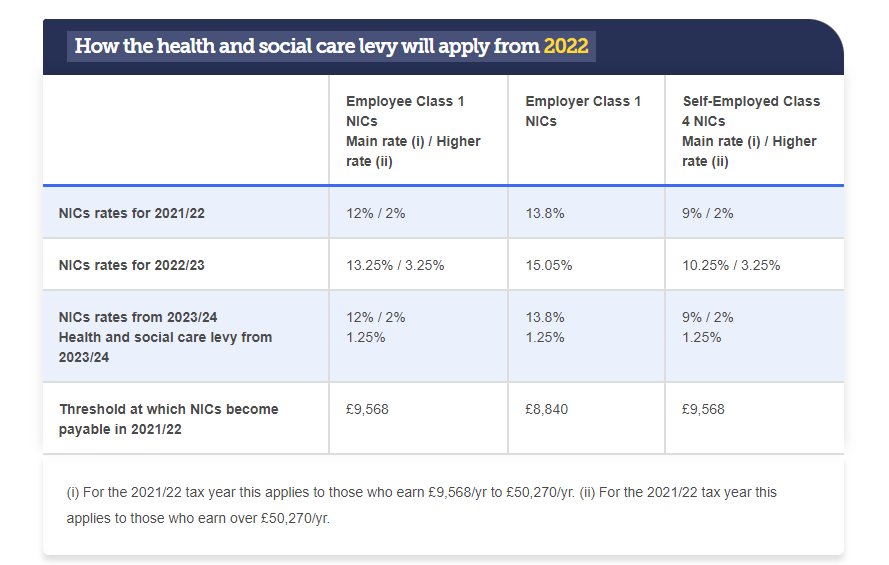

The main rate of class 1 employee nics will be reduced. Paye tax and class 1 national insurance contributions.

On 6 january 2025, class 1 national insurance contributions (nics) are to be lowered from 12% to 10%.

The rate of employers nic for salary over £9,100 per annum remains at 13.8%, which means that if you pay yourself a salary of £12,570, the employers nic for.

How is National Insurance Calculated? (+ NIC Rates for 2025), There are three classes of nic relevant to employment income: In a move that the treasury estimates will cost £9bn per annum, the main class 1 rate of employee nics is to be cut from 12% to 10%.

National Insurance Rates 2025/24, Class 1 national insurance thresholds. In a move that the treasury estimates will cost £9bn per annum, the main class 1 rate of employee nics is to be cut from 12% to 10%.

Tax year 2025/2025 resources PAYadvice.UK, Standard / emergency tax code: A reminder that the main rate of class 1 employee national insurance contributions (nic) will be reduced from 6 january 2025.

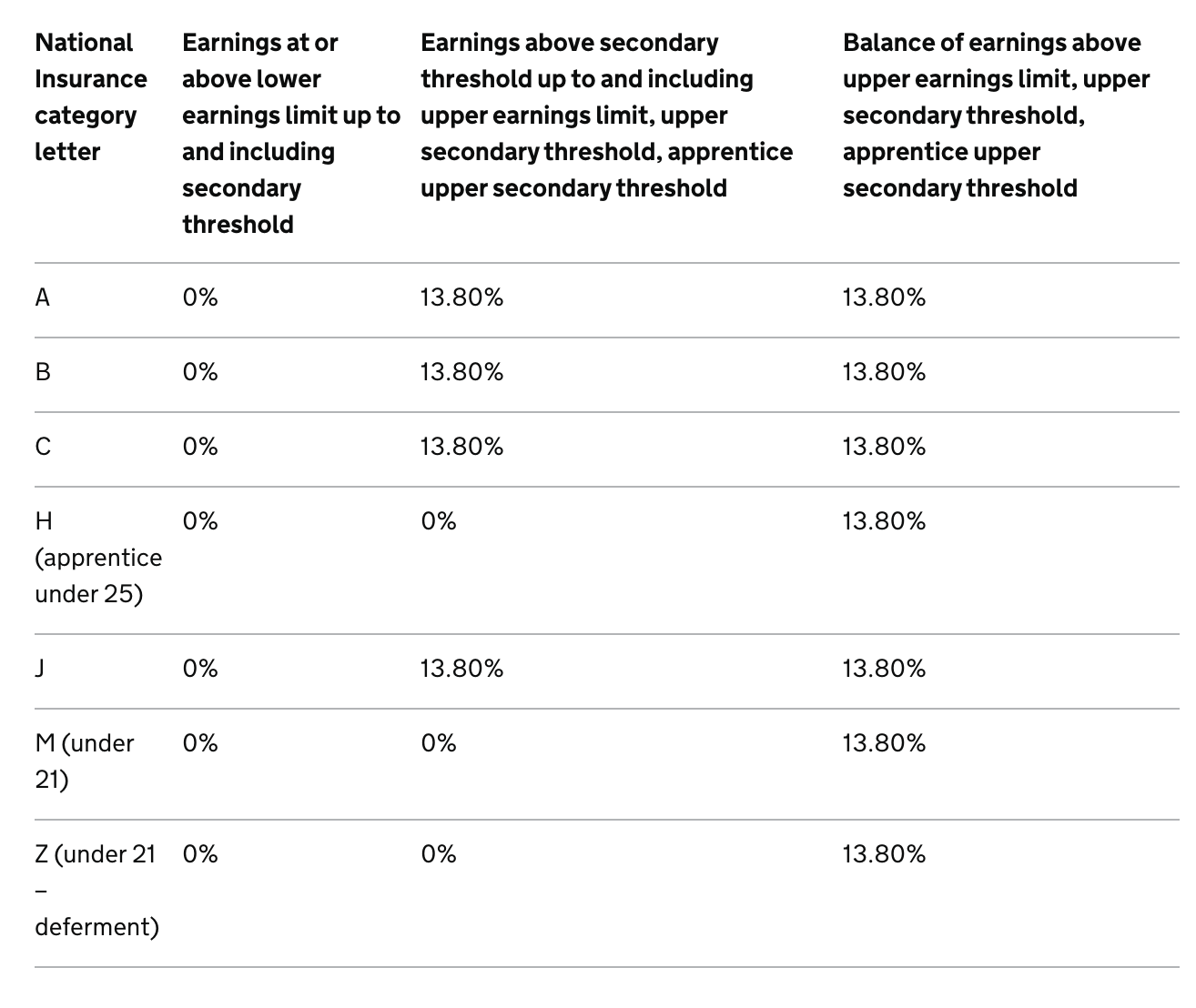

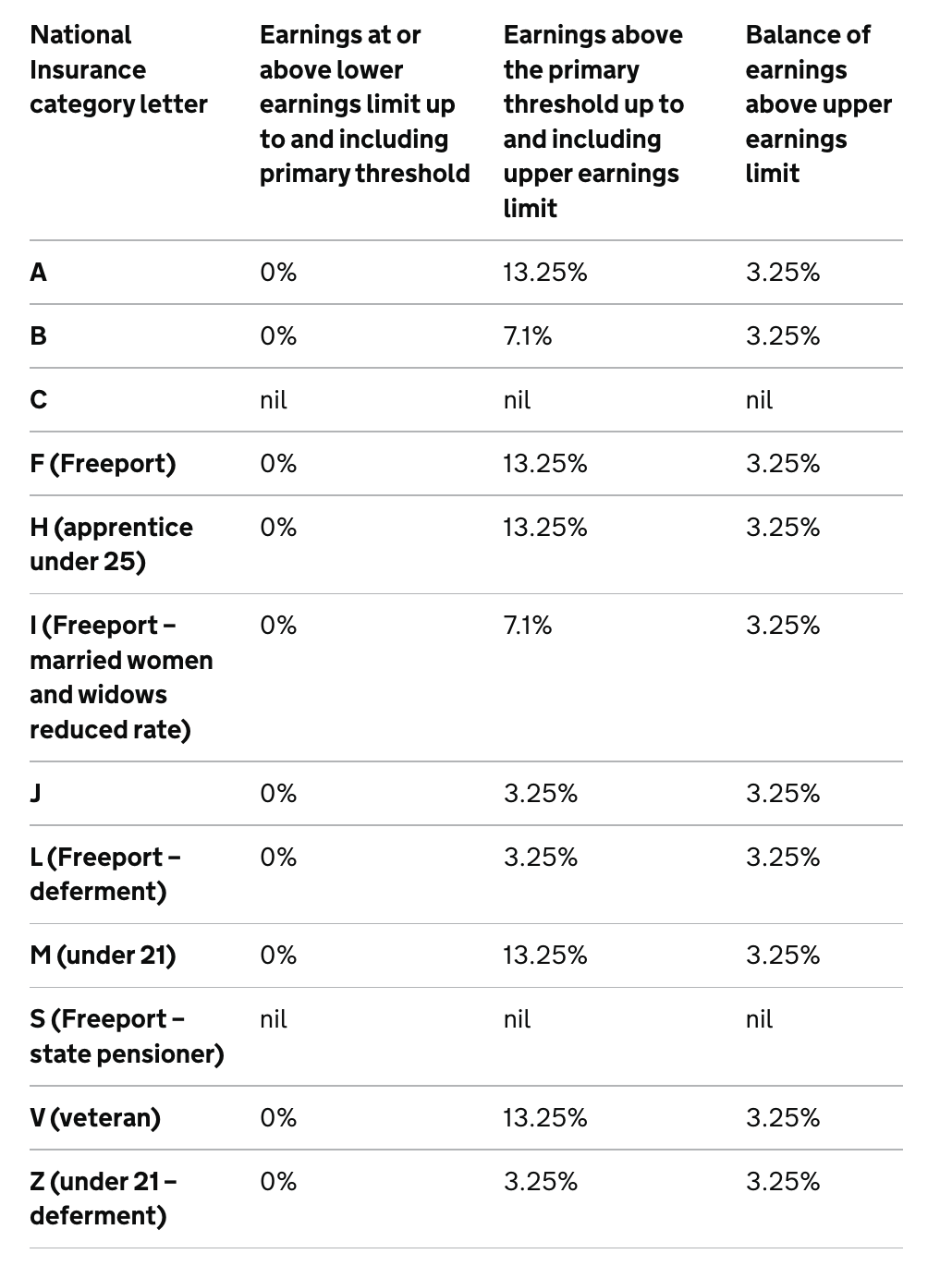

Employers NI Calculator 2025 for Multiple Employees, Legislation to enact the change is expected to be introduced in the next few days. This table shows how much employers pay towards their employees’ national insurance.

National Insurance threshold Terese Parkinson, This table shows how much employers pay towards their employees’ national insurance. The employer national insurance contributions calculator is updated for the 2025/25 tax year so that you can calculate your employer nic's due to hmrc in addition to standard.

CPF allocation rates How they change as you grow older Endowus SG, The national insurance class 1a rate on termination awards and. = earnings subject to employer's nics:

upper apparatus booklet directors national insurance calculator finish, National insurance rates for employers. From 6 january 2025, class 1 employee national insurance contributions (nics) will be cut from 12% to 10%.

Increases to National Insurance rates for Employees, Employers, Self, Employers must pay national insurance for all staff salaries above the secondary threshold (the minimum amount an employee. = earnings subject to employer's nics:

upper apparatus booklet directors national insurance calculator finish, National insurance contribution (nic) changes coming into effect from 6 january 2025. National insurance contributions thresholds 2025/25.

Irs Tax Brackets 2025 Vs 2025 Annis Hedvige, Autumn statement 2025 announced that national insurance contribution. Legislation to enact the change is expected to be introduced in the next few days.